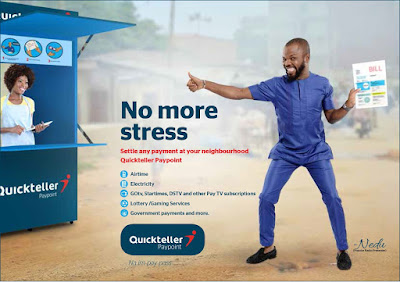

You can now make money in Nigeria if you become a Quickteller Paypoint agent in Nigeria.

As an agent, you will be able to manage Paypoint for Quickteller and have access to an array of exciting commissions and incentives as you offer financial services like Bill Payment, Funds Transfer, Cash Deposits, Cash Withdrawals, Insurance and Airtime Recharge to customers.

Quickteller Paypoint is the trade name for IFIS Agent locations. It’s a one-stop shop where all the products/services provided by IFIS Ltd can be accessed and purchased. IFIS (Interswitch financial inclusion services) is licensed by the Central Bank of Nigeria to provide digital financial services aimed at bringing basic financial services to the door-step of the unbanked/underserved Nigerians, currently estimated at more than fifty million adults.

The following services are available at any Quickteller Paypoint:

Individuals, small to mid-size businesses, institutions etc can become Quickteller Paypoint Agents upon registration and submission of requisite documentations. The requirements are based on the class of agent applied for e.g. classic, standard and prestige.

Individuals and unregistered businesses (mass/umbrella agents) fall under Classic category.

MSMEs, mom-and-pop shops, salons, supermarkets, chemist shops, grocery stores, etc. fall under the Standard category; whilst

Bigger businesses like petrol stations, pharmacy chains, Quick Service Restaurants (eateries), etc. fall under the Prestige category. Institutions with structures like MFBs also fall under the Prestige category.

Having an existing business which attracts reasonable footfall is a basic requirement. In addition, one must have a physical location that is easily accessible to people as well as an acceptable means of identification.

For corporate entities and institutions, business registration/incorporation documents will also be required.

You can also fill the online form at : https://www.interswitchgroup.com/ng/financial-inclusions/become-an-agent---form

As an agent, you will be able to manage Paypoint for Quickteller and have access to an array of exciting commissions and incentives as you offer financial services like Bill Payment, Funds Transfer, Cash Deposits, Cash Withdrawals, Insurance and Airtime Recharge to customers.

Quickteller Paypoint is the trade name for IFIS Agent locations. It’s a one-stop shop where all the products/services provided by IFIS Ltd can be accessed and purchased. IFIS (Interswitch financial inclusion services) is licensed by the Central Bank of Nigeria to provide digital financial services aimed at bringing basic financial services to the door-step of the unbanked/underserved Nigerians, currently estimated at more than fifty million adults.

What are the transactions that can be carried out at a Quickteller Paypoint?

The following services are available at any Quickteller Paypoint:

- Airtime recharge (all networks)

- Bills payment/settlement (electricity bill, water bill, Waste bill, DStv, GOtv, Startimes, actv, Local and State government levies/taxes, estate permits, etc.)

- Funds transfer (sending money to, and receiving money from, any person nationwide)

- Account opening with any bank

- Payments – for insurance premiums, airline tickets, embassies, etc.

- Deposit of funds (cash-in) into own or a thirdparty account

- Withdrawal of funds (cash-out) from own account

Who Can Become Quickteller Paypoint Agent?

Individuals, small to mid-size businesses, institutions etc can become Quickteller Paypoint Agents upon registration and submission of requisite documentations. The requirements are based on the class of agent applied for e.g. classic, standard and prestige.

Individuals and unregistered businesses (mass/umbrella agents) fall under Classic category.

MSMEs, mom-and-pop shops, salons, supermarkets, chemist shops, grocery stores, etc. fall under the Standard category; whilst

Bigger businesses like petrol stations, pharmacy chains, Quick Service Restaurants (eateries), etc. fall under the Prestige category. Institutions with structures like MFBs also fall under the Prestige category.

Having an existing business which attracts reasonable footfall is a basic requirement. In addition, one must have a physical location that is easily accessible to people as well as an acceptable means of identification.

For corporate entities and institutions, business registration/incorporation documents will also be required.

Benefits of Being a Quickteller Paypoint Agent

- Additional income/commission from IFIS services:- agents earn attractive commission for all QuickTeller services which is an additional income line to the agent’s business.

- Guaranteed volume of transactions due to rich bouquet of products and services.

- Increased sales due to increased footfalls

- Good brand association:– Interswitch brand and growing IFIS network

- Guaranteed training and dedicated field support

- Comprehensive branding and marketing support

- Social relevance to the community –Financial Inclusion services

Quickteller Paypoint Registration Requirements

Interested investors must ensure they possess the following qualities and requirements:- Must be able to read and write

- Must have a functional android enabled mobile phone

- Must have an existing physical shop/business outlet

- A completed Agent application form/agreement and account package

- A copy of ID or equivalent (Driver’s license, Voter's card, National ID card, Int’l passport)

- A Passport-sized photograph

- Proof of Address (Utility bills e.g. PHCN, LAWMA, DStv, GOtv, StarTimes, etc.)

- Financial/Bank account detail or statements

- Items 1-8 above are required to be a Classic or Standard IFIS Agent. However, business registration documents are required to be a Prestige IFIS Agent.

- A minimum start-up capital requirement of N10,000 (This amount is not a fee but your trading capital which will credited to your wallet immediately you are setup)

How Can I Get Started as an Agent to Quickteller?

- Ensure you have a work tool/device (Smart phones that run on Android 4.4 OS)

- Complete and submit the registration form

- Provide the required KYC documents

- Provide the minimum operating capital requirement

- Receive validation and setup details

- Be enlisted for training

- Receive starter pack and branding materials

- Commence live transactions documents will also be required.

What is the Agent Registration/Setup Process?

- Agent completes and submits IFIS Agent Registration Form/Agreement.

- Agent makes provision for the minimum Agent Start-up Capital (N10,000). - Agent funds IFIS operational bank account with the Agent’s minimum start-up capital by either cash deposit or funds transfer for onward credit to Agent’s IFIS account.

- The location and human resource for the agent service are inspected and certified by an IFIS Business support partner (BSP).

- The IFIS agent account is activated and agent receives login details and a credit alert to the tune of the Agent’s deposited start-up capital.

- Agent undergoes IFIS Agent Banking training and receives the following setup kits :

- IFIS Certificate of Completion

- IFIS ID for identification

- Transaction Log Book/Register

- An Agent code

- Branding materials

- Tariff Sheet

- Agent commences full operations.

How To Get Quickteller Paypoint Registration Form

To get the Quickteller Paypoint registration form and bank account details to pay the Quickteller registration fee into, go to https://www.interswitchgroup.com and contact IFIS via the contact details on the site.You can also fill the online form at : https://www.interswitchgroup.com/ng/financial-inclusions/become-an-agent---form

Boss. I'm interested in this. I don't seem to get how to contact them.

ReplyDeletewhere would agents be trained? Is it going to be online or lagos? Pls let me know sir.

ReplyDeleteEht is the commission range of been an agent

ReplyDeleteThis is good, but the problem is : this will be affected by the unemployment situation in the country before you know it, we will have a lot of people doing the same thing and it will be difficult to make money from it. Around my office alone we have about seven people on PAGA platform now all of them are complaining about how the business doesn't worth it again.

ReplyDeleteOoh.. This could be an extra means of income

ReplyDeleteThanks for sharing with us a detailed guide on getting started ......

I blog via MasterGblog